Kenny Rodgers once said, “You got to know when to hold ‘em, know when to fold ‘em, know when to walk away, and know when to run.” The last part of the tune can be struck through as it is the last thing a prudent and engaged investor would ever want to do. Also, he was referring to a game of poker. Here we are talking about I-Bonds, and unless there is a reversal of the current trend and inflation begins to rise again, the time to walk away is coming.

One reason I find this field of work so interesting is that there is a cheat code to being successful. The problem is that the cheat code is boring, and few people are patient enough to use it.

We live in moments. Sometimes those moments seem to pass by in the blink of an eye, while other times the moments seem to last forever.

That dynamic is an incredible blessing as we spend time with our family and friends, creating emotions and memories that last well beyond the time we actually...

We are pleased to announce the addition of Andi Long, CFP® to the Pitzl Financial team! Andi will be working as an Associate Wealth Advisor on our team, and will be responsible for organization, analysis, preparation, and follow-up for your financial plan.

During the past week, we have seen a return to the volatility trends that were prevalent through much of 2022. The past two trading days have been especially active, with the S&P 500 going negative on the year for a brief period on Monday before ultimately turning positive.

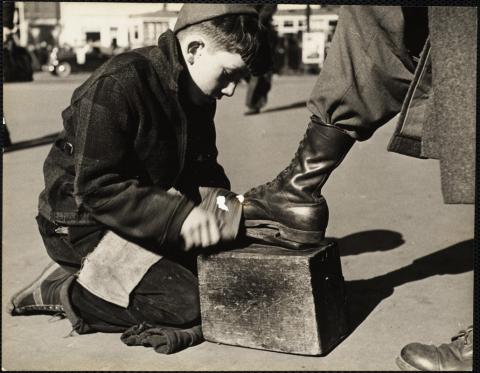

In 1929, at the height of an economic boom in America, Joseph Kennedy Sr. (father of JFK) was working as a stockbroker on Wall Street. As the story goes, Joseph was walking around when he decided to sit down for a shoeshine. While polishing his shoes, the young worker gave Joseph some of his favorite stock picks. When Joseph heard the shoeshine boy giving out stock tips, he figured the party was about to end, and it was time to get out of the market. Joseph proceeded to exit his positions in the market and bought short positions that bet on the market going down.

One of the best things about markets is that they don’t have memories. They don’t

remember what happened last week or last year. They don’t even remember what

happened a minute ago. Prices change based on what’s happening right now and what

people think will happen in the future.

People have memories. Markets don’t. And that’s a good thing.

The start to a new year was a welcome sight for investors. On the heels of a couple of very positive years, 2022 presented a year of struggle across every asset classes.

In what has become a recurring theme, Congress pushed through a new piece of tax legislation in the closing days of 2022. SECURE 2.0, named after its predecessor SECURE Act, brought with it over 100 changes to taxation and retirement plans. Many of these changes involve complex rules and restrictions for retirement plan administrators, and a limited amount for individuals to be concerned with.

On November 8, US voters will cast their ballots for all 435 seats in the House of Representatives and 35 seats in the Senate. Many investors are concerned with the effect of election results. Do past results suggest a useful strategy to deal with election-year uncertainty?

The answer is yes.

Over the past couple of years we have started working with an online bank called Flourish. This is an online bank that works specifically with financial advisors. A few of our clients have already started using this platform to hold their emergency savings. Until now the rates offered have mirrored those at Ally and Capital One fairly closely. But that has now changed.

As we enter the final months of 2022, we are greeted with yet another election cycle. This version, much like its predecessors, has led to an increase in client inquiries about market ramifications relating to the results.