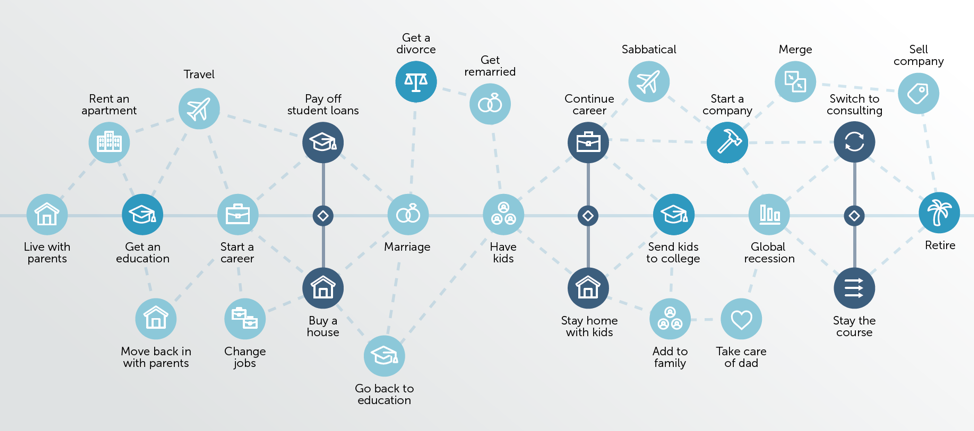

Your partner for all of life’s transitions and financial decisions.

Pitzl Financial is a Minneapolis - St. Paul based fee-only financial planning and wealth management firm. We combine objective financial planning with disciplined investing to Design, Build, and Protect your assets through all of life’s transitions. Our approach to the planning process has consistently earned us a place in the Top 12 Financial Advisory Firms in the Twin Cities.

We believe that the fundamental purpose of financial planning is to help people plan for – and live – a better life. Money is best used in a manner that supports your life rather than being the driving force in the decision-making process. Money is merely a tool to help you live the life you desire.

While many financial conversations revolve around topics like investing, tax reduction, or cash flow planning, some of the most important financial decisions we make are actually about things bigger than money. Our process is not about products. It's about intentionally aligning your personal financial affairs with your values and goals.

We apply evidence-based, academic principles in the technical areas of financial planning and marry them with your unique financial personalities and lifestyle to create a plan that works for you. We strongly believe in a collaborative process where we serve as advisors to you, your family’s CEO(s).

Welcome to Your Personal Boardroom™.