Investment Discipline

Our investment philosophy is built upon an evidence-based approach to investing and rooted in Modern Portfolio Theory.

The most fundamental purpose of developing a coordinated investment plan is to ensure that there is a smart place for you to get money whenever you need it. We recognize that life’s bills do not always come at the peak of a market cycle, so it is critically important to build resiliency into your portfolio. Diversification, discipline and flexibility are fundamental cornerstones of our philosophy.

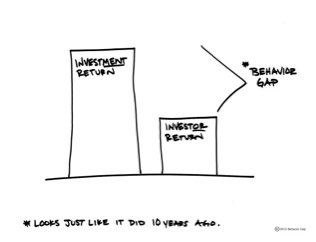

At the heart of our philosophy is the idea that markets are not broken. They have proven to deliver investment returns over time commensurate with the growth of the companies represented by the underlying index. Unfortunately, investors have historically earned returns significantly less than the markets offer.

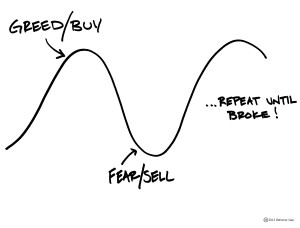

This deficiency is partially due to excessive investment costs, but is more a function of ill-advised investor behavior – buying and selling at the wrong times, being sucked into the prediction game, believing narratives instead of reality, believing markets and economies are the same, etc. As such, our primary focus is ensuring you capture what the markets are providing.

“Individuals who cannot master their emotions are ill-suited to profit from the investment process.” – Benjamin Graham

The three T’s required for effective investment management are Time, Temperament, and Talent. Whether it's a function of busy lives, other interests, or an inability to remove emotions from the decision-making process, most people struggle to maintain all three. Arguably the most important (and most expensive) of the three is temperament – having the ability to control your behavior and emotions. Numerous studies have proven that over time, investments work better than investors.

“I would rather lose half of my shareholders than half of my shareholders’ money.” – Jean Marie Eveillard

We are more concerned with proper levels of portfolio risk management than obtaining the highest possible return in any given year. Contrary to what most people believe, long-term investment success actually requires that you are comfortable underperforming certain areas of the market in a given year in order to maintain the balance and discipline that yields long-term results.

“The stock market has a very efficient way of transferring wealth from the impatient to the patient.” – Warren Buffett

It has been said that the purpose of economic forecasting is to make astrology look respectable. We recognize that a disciplined, diversified investment strategy does not exactly provide for great cocktail party conversation, but we also recognize that it works. Each of us know someone that completely knocked an investment out of the park, so it is tempting for investors to try to get in on the action. However, chasing a hot stock or succumbing to your emotions in a down market can destroy decades of wealth creation.

“Price is what you pay for something, value is what you get.” – Warren Buffett

It has been said that valuation is the closest thing we have to gravity in the financial markets. Regardless of how great a company or sector of the market may seem, high relative prices reduce future returns. Conversely, low relative prices increase future returns. If a particular segment of the market has performed well (as defined by its price increasing), we are more likely to rebalance back to our targets or even reduce the allocation to that segment of the market. Conversely, when a market sector has underperformed, we will likely rebalance back into that asset class.

“I would rather be approximately right than precisely wrong.” – John Maynard Keynes

Patience is critically important in investing, but you can cause a lot of harm by mistaking patience with greed. Trying to get-in early on the next Microsoft, or continuing to ride a hot stock or market sector until the very last minute can lead to detrimental results. We would rather run the risk of rebalancing out of a hot segment of the market a bit early than risk doing so too late.

“Far more money has been lost by investors preparing for corrections or trying to anticipate corrections than has been lost in the corrections themselves.” – Peter Lynch

Do not try to time or predict the market. Investors who understand that timing the market is a loser’s game will be less prone to reacting to short-term extremes in the market and more likely to adhere to their long-term investment plan. It may take years to realize the value you anticipated when you purchased the asset in the first place.

<div style="padding:56.25% 0 0 0;position:relative;"><iframe src="https://player.vimeo.com/video/115055881?badge=0&autopause=0&player_id=0&app_id=58479&h=7d41a86dc7" frameborder="0" allow="autoplay; fullscreen; picture-in-picture" allowfullscreen style="position:absolute;top:0;left:0;width:100%;height:100%;" title="Science of Investing"></iframe></div><script src="https://player.vimeo.com/api/player.js"></script>