Investment Philosophy

Evidence-Based Investing

For most of us, investing is vital in the pursuit of achieving our lifetime goals. However, the term “investing” can mean a lot of different things to a lot of different people.

Between family gatherings, the office water cooler, social media, and conversations with friends, it is incredibly easy to get overwhelmed with the endless number of ways you can try to grow your assets.

One of the most essential elements of the investing process is having the wherewithal to differentiate between investing and speculating.

Speculation is not inherently bad if the risks are understood and the scope of the speculation does not threaten your financial plan. But strategies employed to make money fast are considerably different than those designed to preserve and grow your hard-earned wealth over time.

The finance industry is saturated with great marketers and storytellers whose primary role is to attract your funds with well-delivered pitches. Fortunately, there is also a quieter, more academic arm behind the scenes that studies the intricacies of markets and where returns have come from over time.

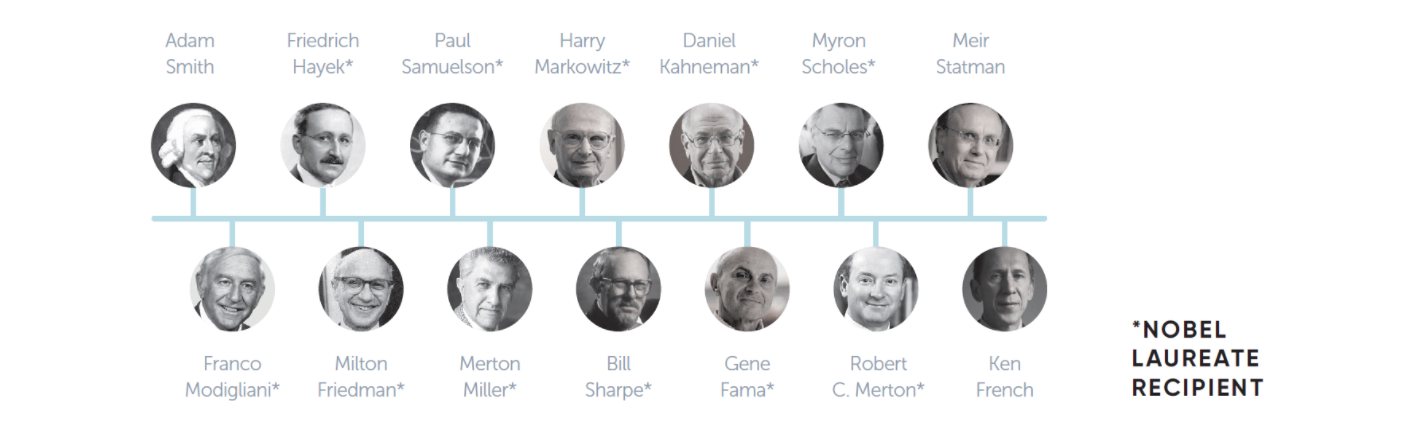

Our process incorporates the research of many great thinkers and economists, including pioneers in behavioral finance and 11 Nobel laureates.

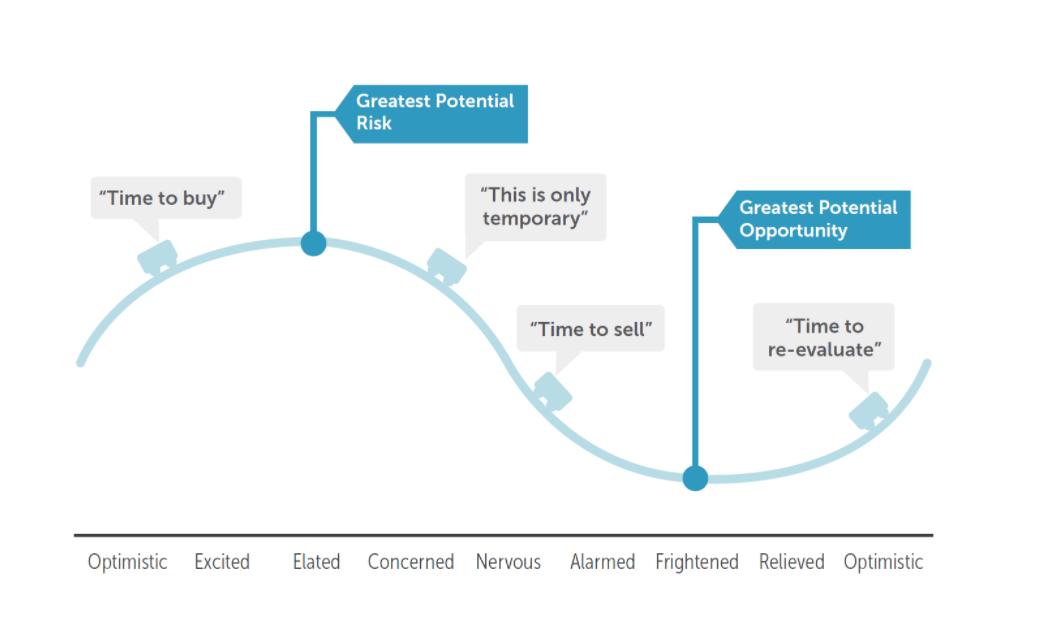

Stock markets have rewarded patient investors handsomely over time. However, the price for these long-term gains can involve living through occasional periods of decline. Understanding your tolerance for these periods when the market goes down is an essential part of building a plan that will work for you.

We know that being patient and disciplined can be extremely difficult, especially when certain assets are soaring or plummeting. The way our brains are hard-wired can cause us to make decisions about our money at precisely the wrong moments.

No one knows what the future will bring, but a solid investment process will help you stay invested and make the correct decisions in a variety of market environments. It should also be flexible enough to reflect changes in your life and financial circumstances.

We are committed to understanding what matters most to you personally and financially. Those conversations lead to your overall financial plan Design.

From there, we Build planning strategies and investment processes into your financial life that aim to give you the highest probability of achieving your goals.

Finally, we seek to Protect your financial plan by monitoring and rebalancing your allocations, keeping pace with any life changes, and paying close attention to the tax impact of trading decisions and the location of assets.

For more information on the Design, Build, Protect process, click here to download our brochure.