Maintaining Perspective in Moments

We live in moments. Sometimes those moments seem to pass by in the blink of an eye, while other times the moments seem to last forever.

That dynamic is an incredible blessing as we spend time with our family and friends, creating emotions and memories that last well beyond the time we actually spend in them.

But it is also a curse, as a simple mis-step, or unlucky timing can lead to a life-altering event before we even register what happened.

We can’t stop or rewind time, and we can’t speed it up either.

In the investment realm, it can sometimes seem as if time stands still. Portfolios can ebb and flow for very long stretches and seem to be doing nothing in the way of making progress. During that time, we get inundated with information that can make our imaginations run wild. The natural inclination is to react and make changes.

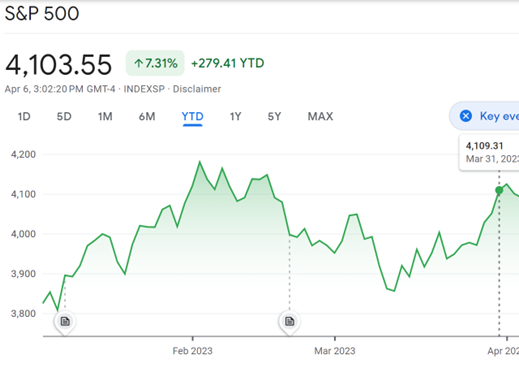

The chart below shows the performance of the S&P 500 for the first quarter of the year. It was rocky and wild if you watched it every day.

The chart for the bond market looks the same.

If we layer in all of the headlines into these peaks and valleys, the chart would be littered with notes such as, Inflation is high. Mass tech layoffs. Bank run causes SVB failure. Corporate leaders expect a recession. China flew a spy balloon across the country. Donald Trump got arrested. Credit Suisse was forced to sell to UBS.

In the moment, this quarter felt painful and scary. Attached to the back-end of a rough year for markets, this feels like it is dragging on with no end in sight.

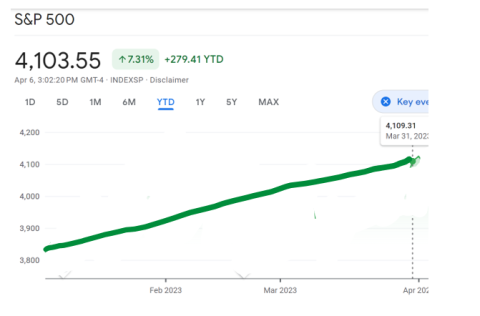

All that said, here is the same chart if you remove the daily volatility and noise.

While we are far from saying the coast is clear, if we simply step away from the onslaught of news, we are doing ok.

To reiterate a point we have made many times over the years, returns come in bunches…both directions. Most of the time, markets kind of slug along and don’t do a lot, but then suddenly, they shoot up or down with no warning.

Yes, the bank failures are cause for concern. However, as the Chief Investment Officer at Buckingham, Kevin Grogan, points out, nearly 500 banks failed from 2008 -2013, so it is a far more common occurrence than most believe. For more perspective on the recent crisis and how that differs from 2008, click here for a short video from Kevin on what took place.

Naturally, on the heels of this, we start to see a barrage of news stories with scary terminology and threatening implications.

There are a lot of stories recently about the dollar being replaced as the reserve currency. If we stop for a moment and process that, does anyone really believe the developed or developing world will trust the Yuan (and its government) more than the dollar?

And even if the dollar were replaced, the US functioned pretty well before it became the dominant currency, and how many dozens of nations get along just fine without their own currency being the global reserve? We’d be ok.

More recently, a client brought up a headline about the threat of the “shadow banking” industry. Because of the term “shadow,” it sounds sketchy and scary. However, shadow banking is really just any form of lending that doesn’t occur under the umbrella of a traditional bank.

Sometimes, traditional banking channels can’t handle the size of a required loan for an acquisition or expansion, but a large private equity firm or hedge fund can supply the capital instead. Shadow banking.

Warren Buffett’s Berkshire Hathaway injects billions of dollars into failing banks during the 2008 credit crisis in exchange for preferred stock and warrants. Shadow banking.

Some of you hold a position in the Cliffwater Corporate Lending fund. Shadow banking.

Like any other market around the globe, there are risky players and investments in the shadow banking realm (especially when you weave in leverage), but the overwhelming majority of what fits under that umbrella is not. It is just a scary term designed to grab attention.

We can easily get caught-up in these moments and end up spending a lot of time going down a rabbit hole.

But when we step back to the big picture, none of these headlines or threats are anything new. They have been there all along, and many of the concerns are the same things we have been hearing about for a decade.

Our time is the most precious resource. Choose how you spend your moments wisely.