I Bonds - Still in Style

Back in April we wrote about an investment vehicle known as I Bonds. These Treasury Bonds, which are tied to inflation, started to offer higher yields than anything you could find on the open market.

With high levels of inflation still being reported these bonds are still a sound investment, but likely for a limited period of time.

Without going too deep into the characteristics (a deeper dive can be found in the link above) every individual, including minor children, is able to purchase up to $10,000 in I Bonds each year. Once these are purchased you are required to hold the bonds for a minimum of 12 months.

As such, if you have already purchased $10,000 this year you are restricted from purchasing more.

Adjustments to I Bonds happen every May and November. Back in May of 2022 the I Bond rate came in at 9.6%. The November 2022 reading is not official yet, but a baseline rate of 6.5% is pretty well known. It could be more than 6.5%, but that is highly unlikely.

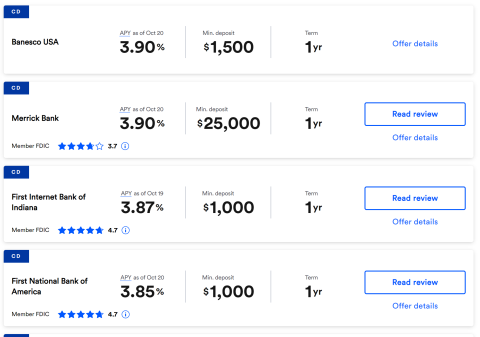

What this means for the folks who have yet to purchase is that you have about a week-and-a-half to lock in the first 6 months at 9.6%, and the final 6 months at 6.5%. This equates to a 12-month interest rate of roughly 8%. For comparison, the highest yielding 12-month CD currently sits a touch under 4%.

Purchases after November will likely come with a lower interest rate on the back half of the 12-month lock-in period. As mentioned before, these bonds are tied to inflation. We’ve seen the inflation readings falling steadily over the past few months, and by the time the May 2023 reading happens it will likely be much lower than the rate we can get today.

For a guide on how to purchase I Bonds please feel free to click here. We have internal team members who have purchased these and would be more than happy to assist. Please don’t hesitate to reach out with questions.