I Bonds - A Guaranteed 8.5% Interest

In the past 12 months, the financial world has been dominated by headlines of low interest rates and high inflation. Up until early March the 1-year treasury yield, which is the percent the U.S. government will pay you to hold your money for 1 year, sat at about 1%. Furthermore, the average U.S. savings account is paying a measly .06%.

On the other side of the equation, inflation has been as hot as it’s been in 40 years. The Bureau of Labor and Statistics recently announced that inflation rose 8.5% between March of 2021 and March of 2022.

Over the past year we’ve often been asked where excess cash, outside of emergency savings, can be put to better use while still offering stability. With rates at historic lows, so too have been interest rates paid on deposits at the local or online banks.

However, a more obscure form of Treasury bond – I-Bonds - has recently emerged as a terrific parking place for funds you are certain you do not need for the next 12 months

What are they?

I-Bonds are Treasury bonds issued by the U.S. government. This means that they are fully backed by the U.S. government, making them as safe an investment vehicle as you can get. For the last decade, these have received very little attention at all, as inflation numbers have been extremely low.

These bonds are comprised of two different factors: a “fixed rate” factor and an “inflation rate” factor. These rates added together give us a “composite rate”. That composite rate is good for 6 months, and will then adjust based on the future inflation readings at the time.

The adjustment to the “composite rate” happens in two months each year: May and November. The most recent adjustment came back on November 1, 2021. At this point the “fixed rate” of I-Bonds was 0%, not super exciting. However, the “inflation rate” was set at 7.12%. Thus the “composite rate” of any money invested in I-Bonds carried with is annualized rate of 7.12%. This results in a 3.56% yield over the first 6-months of all I-Bonds purchased between November 1, 2021, and April 30, 2022.

Until last week, it was not clear what the next 6 months would bring. With all the talk last summer and fall about “transitory” (temporary) inflation, it was unclear how persistent the inflation readings would be this spring.

The April 12 inflation report came back extremely high, which points to a new rate for I-Bonds at 9.62%! Combined with the prior 6 months at 7.12%, this means you can earn 8.54% on a guaranteed basis over the next 12 months on your dormant cash!

Downsides?

The above details seem too good to be true, so what’s the catch?

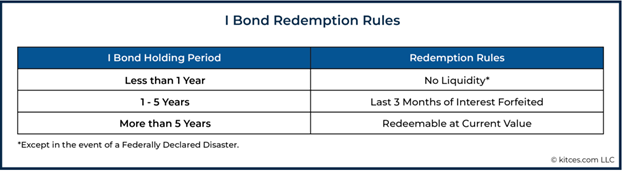

The primary downside with these bonds is a lack of liquidity. In order to redeem I-Bonds, which is to actually access the cash, you need to hold them for a minimum of 1 year. In other words, you cannot access your funds in the first 12 months.

In addition, any bonds held between 1 and 5 years would forfeit 3 months of interest. After the 5-year holding period has been met, you are able to redeem the current value of the bond.

Therefore, if you redeem your bonds after exactly 12 months, you will surrender 2.4% of interest, cutting that 8.54% rate down to 6.13%. That is a sharp drop, but still incredibly favorable relative to other guaranteed options out there.

Another downside is that there is a limit on the amount of I-Bonds you can purchase each year. The current limit is $10,000 per individual. You can buy smaller increments, but $10,000 is the maximum purchase each year. You are also permitted to purchase these for children / minors as well, but in doing so, they are held in custodial accounts for them and are considered a gift.

When purchasing I-Bonds, each individual is required to set up an account with the Treasury (website treasurydirect.gov). These cannot be purchased through brokerage accounts, IRA’s, etc. They literally have to be purchased at the site listed. Unfortunately, that means each spouse in a married couple has to create their own registration and login. Minors can be added to a parent login.

This leads to another pain point in the purchasing process. As with many government websites the process to set up an account can be very frustrating. The same website used for signing up is also the website that is used when redeeming the bond. We have created a guide to help you navigate the process.

So where do these make sense?

Given where I-Bond rates currently sit, and the rises in inflation we continue to see, I-Bonds have become much more attractive alternative to your traditional savings account. There is obviously a huge downside in the loss of liquidity. However, as long as emergency accounts are intact I-Bonds offer a great way to capture some additional government backed yield.