I-Bonds - The Time to Walk Away

Kenny Rodgers once said, “You got to know when to hold ‘em, know when to fold ‘em, know when to walk away, and know when to run.” The last part of the tune can be struck through as it is the last thing a prudent and engaged investor would ever want to do. Also, he was referring to a game of poker. Here we are talking about I-Bonds, and unless there is a reversal of the current trend and inflation begins to rise again, the time to walk away is coming.

As we continue to turn the clock into the second half of 2023, the Fed is making progress toward its objective of tackling inflation. In April of 2022, we put out a blog about I-Bonds, an attractive offer for your excess cash yielding 8.54% over 12 months; fast forward again to October of 2022, and purchasing these would have given you ~8%. This taming of inflation has led to a drop in I-Bond rates, which now have a 12-month compound rate of 4.3%. Of this 4.3%, 0.9% is attributable to an increased fixed rate, and 3.4% is linked to inflation.

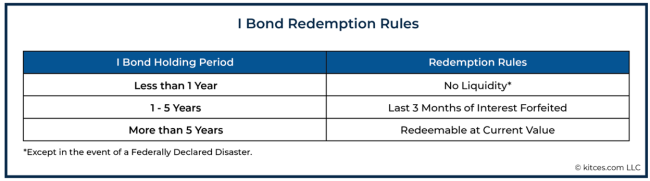

The graphic below illustrates the liquidity of I-Bonds; when you are able to redeem, and what is forfeited based on your current holding period.

For example, those that purchased I-Bonds in April of 2022 would now be eligible to redeem their I-Bonds. When redeeming between a 1- and 5-year period, you forfeit the last three months of interest. Given the new lower rate, redeeming bonds in July would have a forfeit cost of 0.85% from the prior three months of interest. Each of you may have a different time horizon, and thus varying times when it is appropriate for redemptions; we are happy to answer questions on the specifics of this.

The website that was used to purchase the bonds is the same as where you redeem the bond. As with many government websites, the process of redeeming your bonds may be a bit frustrating. We have linked the guide from Treasury Direct to help you navigate this process.

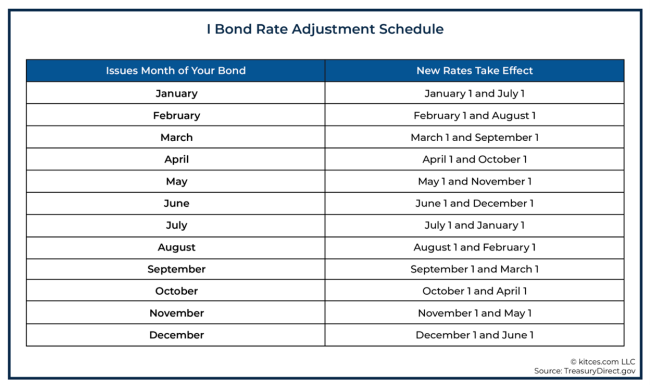

So, when does it make sense for you to redeem your I-Bonds? Given that clients have purchased these at varying issuance dates, the graphic below should give you an idea of when rates change. Our recommendation would be to look out three months after the one-year mark from your initial purchase, and then compare the interest rate in the current period to your alternatives.

With online savings accounts, money markets, and liquid treasuries paying in excess of 4% interest rates, the time to walk away from I-Bonds is on the horizon. Flourish Cash is an offering we have discussed extensively with clients over the last year, with an annual rate of 4.4%. Given the spread between current I-Bond rates and Flourish; the forfeited cost of redemption will be recouped within a year of holding your cash at Flourish.

If you have any questions or concerns, please don’t hesitate to reach out.