Memory Dividends

I feel the best way to begin is with the typical clichés you hear this time of year. "I can't believe it's already September," and "Man, summer absolutely flew by" have been frequent comments during our recent meetings. And honestly, it's completely accurate. Summer was a blur, and 2025 has gone by in the blink of an eye.

My summer was dominated by one thing – weddings. I've reached the point in my life where seemingly every person I've ever met is getting married, all within the same nine or so months.

Things started in May, when I had the honor of officiating my cousin's wedding.

Followed in June with a bachelor party and boat cruise in Mexico City.

July consisted of another bachelor party bouncing around the beach and boardwalk in Myrtle Beach.

And finally, a trip to Portland in August where I watched two of my best friends get married.

On the horizon, there are another four weddings and three bachelor parties before things (hopefully) calm down in February. The mid-to-late 20s phase of life isn't for the faint of heart.

The start of the year was a lot tamer. I spent much of the last week of 2024 and the first week of 2025 traveling around Wisconsin and Chicago, visiting friends and family. Wanting to change things up from my normal boring drives, I decided to take the train. For those who haven't taken the Amtrak route, it's worth the experience at least once. It's not exactly the fastest means of transportation, but it offers you plenty of time to look out at the passing towns, and even more time to do some reading.

During my travels, I brought the book Die with Zero by Bill Perkins. This is one of those books that friends and colleagues have consistently recommended. Unfortunately, the timing with other book releases never seemed to fit. I have to say, I wish I had read it sooner.

Heading into reading this, I figured the general points would be similar to the thousands of other personal finance books out there. These books typically push to save everything you have, let compound interest do its thing, and then buy the Lamborghini you've always wanted once you hit retirement.

In a very typical fashion, judging a book by its cover was the wrong move. Mr. Perkins still advocates for saving money and having enough to live off when you inevitably kick off the work boots. However, he also pushes spending patterns that can be enjoyed in the present, with the experiences providing something he calls memory dividends.

The concept of memory dividends is pretty simple. The experiences you have today with the people you're close with will ultimately be relived and reflected upon down the road. This reflection will produce some happy memories, which will allow you to "cash in" on past events as a memory dividend.

This summer provided me with examples of how impactful these memory dividends can be. If you look closely at the pictures above, you will notice that many of the same faces appear. These are guys I've known for the better part of a decade, with most of them coming from college circles. Our adventures this summer consisted of storytelling from our glory days down in Madison, here in Minneapolis, or at the various cabin and bachelor weekends we've had along the way. It's the same stories we tell every time we see each other, and they never get old. These are our memory dividends.

Bringing this back to the world of finance, this summer has been quite expensive. I've made the joke in client meetings that my Delta status has never looked better, and the AmEx bill has never looked worse. I'm a bit hesitant to put pencil to paper on the total expense from the events that have already happened, as well as the ones coming up. If I had to throw a number out there, it's probably around $10,000.

In years like this, where global markets are comfortably positive, it can be a tough pill to swallow. When you extend that out over the next thirty to forty years, it's fairly reasonable that the $10,000 spent this year would approach $100,000 when I'm ready to join our clients in retirement. Sure, inflation eats into some of that, but $100,000 is still a good chunk of change.

But you know what, I'll give up that $100,000 down the road for the experiences I've had this year. My buddies and I spent most of the wedding in Portland talking about the bachelor party. The wedding I'm in this week will have plenty of stories from Myrtle Beach. Those memory dividends I mentioned before are actively being paid.

Now, I'm certainly not advocating for folks to blow every last cent today and not plan for the future. I still save to our company 401(k), my Fidelity accounts, and always make sure I'm not outspending my paycheck. The points from the typical personal finance books are still valid. There's going to be a point in the future where I want to step away from financial planning and into a less intense phase of life. (For our clients I work with directly, this is many decades down the road. I'm buckled in here for a while!)

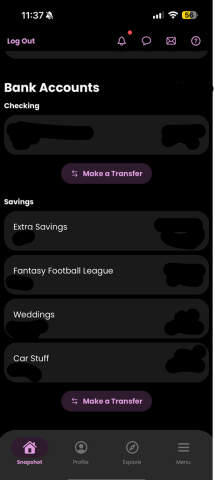

However, I know there's a need to take advantage of things today, which also requires a fair amount of planning. The reason I have felt no guilt spending on these occasions is that I allocate a lot of cash flow to savings buckets meant explicitly for this purpose. Below is an actual snapshot of how I save for upcoming or random expenses. The "Weddings" bucket, which started the year off looking pretty healthy, has taken a significant hit. But hey, the funds have been used for the exact purpose they were saved for!

At the end of the day, it's still incredibly important to save for the future. If the trips with the people I'm close to are fun now, even when we're piling eight guys into a three-bedroom Airbnb, I can only assume they'll be even better down the road when we have more money to play with. Until then, we're going to keep living a little bit today and make the most of those experiences while we can. Future me might be worth $100,000 less, but there should be plenty of memory dividends there to ease the pain.