Life Under COVID-19: Social Distancing, e-Learning, Fear, Opportunity(?) & Hope

It goes without saying that we are all trying to get used to a new reality. For those of us in the working world, it is a regular occurrence these days to have conference calls interrupted by children and dogs barking in the background. This is now more of an expectation than an annoyance.

For those not working or in compromised situations, these are frightening and uncertain times, to say the least. Talking a walk, seeing a neighbor, or simply going to buy prescriptions or groceries is an extremely surreal feeling.

First and foremost, that the outpouring of support and concern from our clients during this stretch of time has been unprecedented…and we sincerely appreciate it.

Many, many, many of you have gone out of your way to ask how we are doing. And for the second time in three sentences…I will reiterate that we sincerely appreciate it.

After markets closed last night, the US Senate passed what they are calling “phase 2” of a stimulus package aimed primarily at expanding unemployment benefits, paid sick leave and expanding free testing for the novel coronavirus that has very rapidly spread across the globe, bring life as we know it to a screeching halt.

The European Central Bank announced an $821 billion stimulus package for its member nations, stating that:

“The ECB will ensure that all sectors of the economy can benefit from supportive financing conditions that enable them to absorb this shock,” the central bank said in a release. “This applies equally to families, firms, banks and governments. The Governing Council will do everything necessary within its mandate.”

Notably, this is separate from any stimulus enacted by individual member countries or the Eurozone at large.

As phase two was being finalized, the Senate also announced that they are already working on (and getting close to) the “big one.” The phase 3 package is expected to eclipse any stimulus in history, with an aim of putting much needed cash in the hands of those who need it most, offering / extending loans and grants to small businesses for several months to keep employees on the payroll, make sure our critical services stay afloat, etc. But speed is vital.

They are expected to vote on this in the coming days. There are many of the major provisions both sides already agree upon, but both parties have different opinions on the details. One of the most major provisions is to provide $1,000 – $1,200 per adult and $500 per child to all families under certain income limits to replace lost income. In addition, there are rumors of possibly providing forgivable loans to small businesses that keep their payrolls in-tact during this period, and large sums to mass produce ventilators and additional hospital space. In addition, student loan relief may be on the table as well.

Overnight, China also announced they have no new cases of Covid-19 for the first time since the outbreak. While many continue to question the accuracy of that information, new cases have slowed dramatically even as the country is back up and running. If nothing else, this clearly indicates that quarantining and distancing measures do indeed work.

At the more micro level, we are also starting to hear of some lenders that are allowing mortgage payments and car loans to be deferred for up to 4 months as a result of several additional initiatives on the Federal Reserve side of things, and we will likely be hearing more about these over the coming days and weeks.

While this process seems incredibly slow (and markets continue to punish the lack of urgency), the reality is that during the last crisis in 2008, Congress did not enact any stimulus until 5 months after it began.

But today in the social media era, every minute feels like an hour, every hour feels like a day, every day feels like a week, and every week feels like a month. Things are happening so fast, and in the race to be first, the quality of information is all over the board.

Over the last several days, however, one thing has become very certain. On a global scale, governments and central banks are seemingly going to stop at nothing to make sure that this virus gets adequately addressed, and they are going to try their best to ensure families and businesses can weather the storm. They are bringing some exceptionally large efforts to the table.

Today, as Congress closed-in on the stimulus package, the White House announced that a long-time malaria drug that was effective against SARS has been showing promising results against Covid-19, and the FDA will immediately begin testing it for effectiveness and appropriate dosage. Many other companies and researchers are exploring effective treatments in addition to ultimately arriving at a vaccine. Will these work? Of course we don’t know that for sure. But we are sure that the very best and brightest minds are working on it.

Here are a couple of links discussing potential treatments and vaccination progress from the FDA and The Gates Foundation.

Markets always price in what information they think they know, and in cases of extreme uncertainty, that is the worst-case scenario. All of our lives went from “be cautious” to “shut down” almost overnight. As a result, the market has already priced in a recession. What remains to be seen is how fast Congress will act, and will it be quick enough to be effective?

The incredible dichotomy this time around (relative to 2008) on a personal level has been pretty fascinating to live through. I (Joe) spent time this evening looking through my emails, meeting notes, and notes from phone conversations over the last several weeks, and on a ratio of 7-to-1(!), inquiries and questions are skewed toward:

(7) Should we scrounge through every couch cushion, and consider robbing from our neighbors to get cash into the market? Should we increase our stock allocation?

(1) We are really freaking out

In 2008, this was completely the opposite. Everyone believed the end was near.

To the former, we have a plan for a reason. The plan is executed before a crisis hits, it will be executed during a crisis, and it will be executed afterward, regardless of your emotional state of mind and convictions on recovery, the (hopefully) temporary state of things, and available bargains in the market.

We share some of those sentiments. If you have excess assets outside of those considered in your plan and reserves, sure, you can afford to gamble a bit. But no, you should not do a cash out refi, draw on a home equity line of credit, or deplete your stated and set aside cash reserves in times like this.

To the latter, we have a plan for a reason. The plan is executed before a crisis hits, it will be executed during a crisis, and it will be executed afterward, regardless of your emotional state of mind and lack of conviction on recovery, the permanent state of things, and feeling that you have to get out of the market and salvage what is left.

We share some of those sentiments. Your assets are all considered as a part of your plan, and bailing now is a much bigger gamble and will likely cost you an awful lot more than it may feel. You have cash reserves and have aggressively paid down debt for a reason. This was done in advance to prepare you for times like this.

Unquestionably, portfolios have suffered significant declines, and while we are confident they are temporary and will recover once the worldwide commitment to tackling this pandemic is widespread, we acknowledge the human challenge of living through it.

Rick and I both were in the investment world during the 2000-2002 and 2008-2009 crashes. Your portfolios are designed with a philosophy and system that weathered those storms, and we will persevere through this one as well.

We continue to reiterate our practice of rebalancing when we break our tolerance bands, and we will continue to slowly add to stocks as markets decline. When markets drop, we buy some stocks as they fall. When they fall further, we buy a little more. And when they fall further, we buy some more. Each time is not a massive shift of all your bonds to stocks. Rather, it is a time-tested and calculated approach to restore your allocation to where it should be.Inevitably, when markets do recover, this ensures you own more shares of each stock or fund on the way up than you did on the way down.

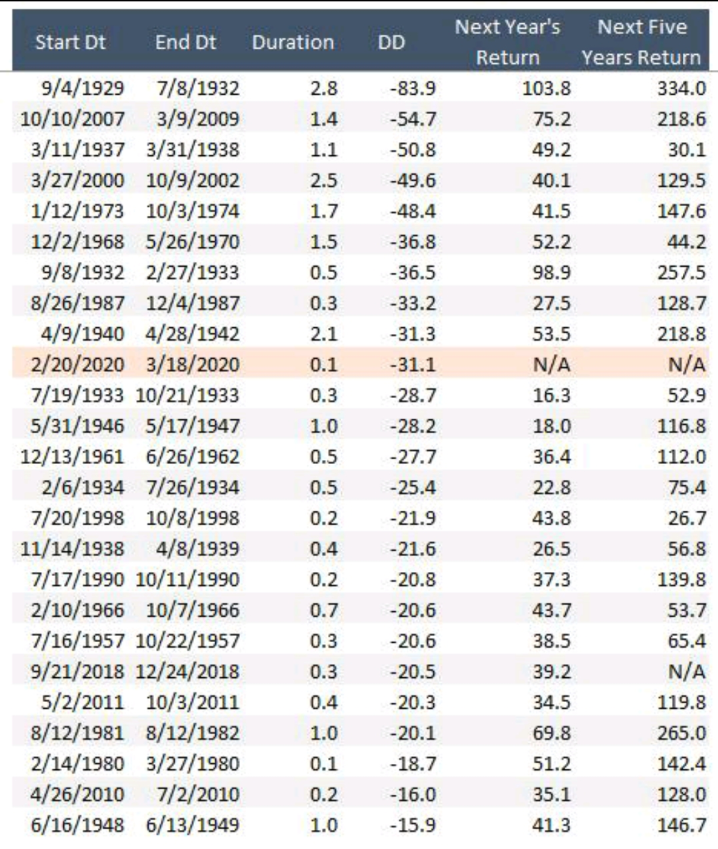

Courtesy of Buckingham’s Chief Investment Officer, Jared Kizer, here is a snapshot of every 15%+ drawdown since 1929. If you continue to nibble a little on the way down, eventually you benefit when the tides turn back upward.

What makes investing one of the most complicated human exercises is that risk is always greatest when the skies seem perfectly clear. And although it doesn’t feel like it, risk is always the lowest when it seems there is no end in sight.

When markets are at a peak, the downside risk is actually far greater than it feels today. When markets are at a bottom, the math reverses and the additional downside risk is far less than the potential upside. Neither of these facts feel right at the time. Can it go lower? It certainly could. But the only way to ensure you really lose what is reflected on paper is to act on it.

Nonetheless, numerous famous investors have come out over the last few days proclaiming the end of the market decline is near.

Bill Miller, a legendary fund manager who outperformed the S&P 500 for 15 consecutive years at Legg Mason, called this one of the best buying opportunities of his lifetime.

Jeffrey Gundlach, better known for his prominence in bond markets, stated that this is the first time in years that he has not held a single position short (betting against the market).

Warren Buffett stated that if you live long enough, you’ll see everything in markets. But by far, 2008 was much scarier than anything that is happening now in markets. And coronavirus is not a reason to not buy stocks.

All of them acknowledged that markets could absolutely go further, but their point is that what is priced in right now is pretty dramatic.

And look, there is no other way to state it: markets over the last month have sucked. US stocks are down. Foreign stocks are down. Gold is down. Bitcoin is down. Corporate bonds are down. High-yield bonds are down. But in the midst of that, high-quality bonds and cash are up.

Systemic market changes typically emerge by country, region, or asset class. When they all head south together, that is something different. In financial jargon, it is referred to as a wash-out. As far as markets are concerned, these are not fundamental shifts, this is what textbook panic looks like.

The only safe-haven over the last month has been high-quality bonds and cash. When we allocate portfolios, we use exclusively high-quality bonds. It has always been the very best source of diversification in times like this.

When things are good, this asset class can be agonizing, causing a drag on returns. But this is also your source of withdrawals (or your dry powder to rebalance with) in moments like this. If you are solely staring at total portfolio balances, this is very easy to overlook, as total numbers have most certainly declined, but those assets – that portion of your portfolio – has held firm. And those assets are there for a reason.

As it stands today, markets are where they are, and they got here very quickly. Since we have already taken a gut punch and the wind has been taken out of us, you now have the quirky math of compounding in your favor from here.

Each leg down from here represents a smaller dollar amount. In dollar terms, the next 25% down is smaller, then the next 25% is even smaller than that. Conversely, each leg up from here represents a larger dollar amount.

If you start with $100,000 and your balance declines by $30,000, you have $70,000 less. In order to drop $30,000 more, it actually requires an even worse decline than we already experienced. Another equivalent 30% drop is now $21,000. It takes an additional 43% from here to equal $30,000 again.

We can’t go back and change what has happened, but we can make decisions in the present. This is not a time to get crazy, but it is also not a time to abandon ship.

As we wrote the other day (quoting Morgan Housel), in hindsight:

market crashes always go too far, and

markets always rebound before the economy.

These times are unprecedented. And the government response around the globe appears to be heading toward unprecedented levels. There are several extremely promising treatments in the works, and the reemergence of life in early countries like China and Korea offer some hope that there is an end in sight.

There are no certainties in investing, but based on the evidence of crashes past, with a high degree of confidence we believe that markets will bottom well before COVID-19 cases peak.

It is a largely foregone conclusion the cases will rise, and markets already know that. If you are waiting for Covid-19 to peak to feel safe about investing, the rebound will have already taken place and be long gone.